4 Real Estate Companies to Consider as Existing Home Sales Rise to 17-Month High

×

[PR]上記の広告は3ヶ月以上新規記事投稿のないブログに表示されています。新しい記事を書く事で広告が消えます。

4 Real Estate Companies to Consider as Existing Home Sales Rise to 17-Month High

As lower mortgage interest rates continue to encourage consumers to buy houses, the National Association of Realtors reported on Thursday that existing home sales in the U.S. reached a 17-month high in August, increasing 1.3% to a seasonally adjusted annual rate of 5.49 million units.

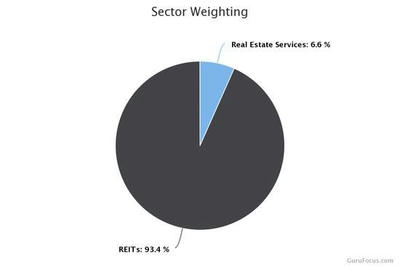

Therefore, investors may find good value opportunities among real estate companies that are trading below Peter Lynch value. According to the GuruFocus Industry Overview page, sectors that make up the space are real estate services and real estate investment trusts.

The legendary investor, who generated average annual returns of 29.2% while managing Fidelity's Magellan Fund between 1977 and 1990, developed this method in order to simplify his investment process. With the belief good, stable companies eventually trade at 15 times their annual earnings, Lynch set the standard at a price-earnings ratio of 15. Stocks trading below this level are often good investments since their share prices are likely to appreciate over time, creating value for shareholders. In addition, the GuruFocus All-in-One screener looked for companies that have business predictability ranks of one or more stars and have seen their revenue per share grow by at least 6% over the past decade.

As of Sept. 19, the screener found Consolidated-Tomoka Land Co. (CTO), Jones Lang LaSalle Inc. (NYSE:JLL), Manhattan Bridge Capital Inc. (NASDAQ:LOAN) and iStar Inc. (NYSE:STAR) met these criteria.

Consolidated-Tomoka Land

The Daytona Beach, Florida-based company, which provides real estate services and invests in income-producing properties, has a $331.88 million market cap; its shares were trading around $67.40 on Thursday with a price-earnings ratio of 12.08, a price-book ratio of 1.85 and a price-sales ratio of 4.47.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued.

GuruFocus rated Consolidated-Tomoka's financial strength 3.7 out of 10. As a result of issuing approximately $143.7 million in new long-term debt over the past three years, the company has poor interest coverage. In addition, the Altman Z-Score of 1.65 warns it could be at risk of going bankrupt.

The company's profitability and growth fared much better, scoring a 9 out of 10 rating on the back of operating margin expansion, strong returns that outperform over half of competitors and a moderate Piotroski F-Score of 6, which indicates business conditions are stable. Consolidated-Tomoka also has a business predictability rank of one out of five stars. According to GuruFocus, companies with this rank typically see their stock gain an average of 1.1% per annum over a 10-year period.

Of the gurus invested in Consolidated Tomoka, Hotchkis & Wiley has the largest stake with 0.98% of outstanding shares. Jim Simons (Trades, Portfolio)' Renaissance Technologies, Mario Gabelli (Trades, Portfolio) and Chuck Royce (Trades, Portfolio) are also shareholders.

Jones Lang LaSalle

The commercial real estate services company, which is headquartered in Chicago, has a market cap of $7.10 billion; its shares were trading around $139.29 on Thursday with a price-earnings ratio of 13.6, a price-book ratio of 1.66 and a price-sales ratio of 0.39.

According to the Peter Lynch chart, the stock is undervalued.

PR

コメント

プロフィール

HN:

No Name Ninja

性別:

非公開